Gold: Symbol of Wealth and Power

Together with silver, gold is the oldest form of investment in the world. In ancient times it was the embodiment of wealth and power. Up to the present day not much has changed. It is still held in safe keeping in the form of gold coins or bullion, as a financial safeguard. It is stored in vaults, bank deposit boxes and strongboxes. In times of financial crisis it enjoys wide popularity as a stable investment and secures the liquidity of the owner and indeed whole nations.

Investment Gold: Loses its Stability

In the meantime gold is seldom used as a method of payment. Also its function as a stable investment has decreased. Although gold, as previously, counts among one of the most constant-valued types of investment, but due to the abolition of gold price fixing in March 1968, this precious metal is sometimes susceptible to high exchange rate and price fluctuations. Whereas the value of a fine ounce of gold for a private person used to have a fixed price of 35 US$, now higher profits or losses are possible when speculating with gold as an investment commodity.

Definition of Investment Gold

The requirements that gold must have, to be defined as investment gold, are defined in a term according to an EU guideline from July 1998. Investment gold is described as follows: gold bullion or gold platelets with a weight acceptable for the gold market and a fine gold content of at least 995 thousandths […] or gold coins which have a gold content of 900 thousandths. “For gold coins it is additionally crucial that the coins were minted after 1800, were or are an official method of payment in their country of origin and are sold at a price that does not exceed the current gold price of their gold content by 80 %”.

Types of Investment Gold

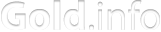

There is a general distinction made between the two different types of investment gold – physical gold (gold coins, gold bullion) and gold traded on the stock exchange. Physical gold includes gold bullion, gold coins – so-called investment coins or bullion coins – also gold jewellery. Gold traded on the stock exchange in the form of an investment implies securities, which are subscribed by the purchaser and their value is subject to the gold price. The most popular and most widespread investment type is however the gold investment in the form of gold bullion and gold coins.

Gold Coins as Investment Gold

Gold coins used as investment objects have an extremely high gold content (up to 999.9 %). They have been used as a stable method of payment for centuries. In the meantime they are first and foremost used as an investment (investment coins) or as collectors items (collector coins). Rare collector coins are often traded at prices which are appreciably above the pure material price. Altogether a pure investment object and a coveted collectors object – investment coins combine the properties of gold bullion and rare gold coins, hence they are also called “bullion coins”. The best known investment coins are listed in the following overview:

- American Buffalo (USA, Mint: United States Mint)

- American Gold Eagle (USA, Mint: United States Mint)

- Andorra Eagle (Andorra, Mint: Bayrisches Hauptmünzamt)

- Britannia (England, Mint: Royal Mint)

- Krugerrand (South Africa, Mint: Rand Refinery)

- Libertad (Mexico, Mint: Casa de Moneda de Mexico)

- Maple Leaf (Canada, Mint: Royal Canadian Mint)

- Goldvreneli (Switzerland, Mint: Schweizerische Münzstätte Bern)

- Wiener Philharmoniker (Austria, Mint: Münze Österreich)

- Nugget (Australia, Mint: Perth Mint)

Gold Bullion as Investment Gold

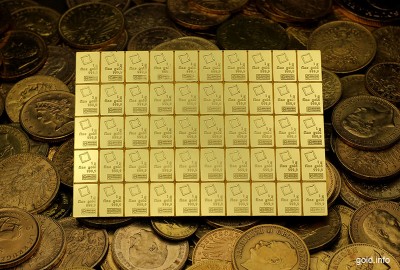

Pure gold and nothing else – investment gold is usually traded in the form of gold bullion. A standard gold bar (“London good delivery bar”) weighs 12.44 kilograms (400 fine ounces) and has a gold minimum fine content of 995 thousandths (995 – 1000 parts of pure gold). The smallest bars have a weight of 1 gram (gold platelets). Additional weight classes for gold bars are 2 g, 5 g, 10 g, 20 g, 1 ounce („1 oz“, 31.1 g), 50 g, 100 g, 250 g, 500 g and 1 kg. The weight, the purity, the name of the mint and foundry and a serial number are stamped on each gold bar. The names of the most important manufactures of gold bullion are listed below:

- Argor Heraeus (Swiss)

- Degussa (Germany)

- Engelhard Corporation (USA)

- ESG (Germany)

- Heimerle + Meule (Germany)

- Heraeus (Germany)

- Johnson Matthey Company (England)

- Metalor Technologies (Swiss)

- Pamp (Swiss)

- Umicore NV/SA (Belgic)

- Valcambi (Swiss)